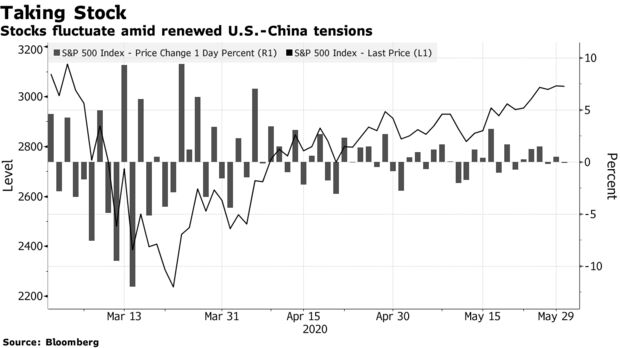

U.S. stocks rose as investors focused on signs of economic recovery amid further tension with China, lackluster virus drug-test results and the threat of further civil unrest in America. The dollar slumped.

The tech-heavy Nasdaq Composite outperformed after a closely watched measure of U.S. manufacturing rose in May for the first time in four months, suggesting stabilization after a pandemic-driven plunge. Gun manufacturers rallied in the aftermath of the protests. Gilead Sciences Inc. fell after its drug remdesivir showed only a limited benefit in a large trial.

Risk assets showed signs of resilience after stocks had dipped earlier following reports that Chinese officials had told agricultural companies to pause purchases of some U.S. farm goods including soybeans, threatening a hard-won trade deal. Metals and emerging-market equities advanced along with shares in Europe and Asia.

Investors mostly looked past the weekend of violent protests across major U.S. cities, highlighting what many see as the disconnect between Wall Street and Main Street. Stocks are near a three-month high as businesses reopen following shutdowns caused by the coronavirus, even with 40 million Americans having filed for unemployment benefits.

“Progress on the road to an economic recovery could help offset pressure on the equity market from near-term challenges stemming from geopolitical, health, and societal risks,” John Stoltzfus, chief investment strategist at Oppenheimer, wrote to clients.

China’s Caixin purchasing managers’ index for manufacturing rose above 50 May, indicating an expansion. Euro-area data on Monday also signaled factories have started down their long road to recovery. Goldman Sachs Group Inc. said the U.S. labor market is showing the earliest signs of rebounding.

Here are some key events coming up:

- In Europe, the ECB is expected to top up its rescue program with an additional 500 billion euros of asset purchases at a meeting on Thursday. Anything less than an expansion would be a big shock, Bloomberg Economics said.

- The U.S. labor market report on Friday will probably show American unemployment soared to 19.6% in May, the highest since the 1930s.

These are the main moves in markets:

Stocks

- The S&P 500 Index rose 0.4% as of 1:05 p.m. New York time.

- The Stoxx Europe 600 Index climbed 1.1%.

- Hong Kong’s Hang Seng Index increased 3.4%.

- The MSCI Asia Pacific Index increased 1.7%.

Currencies

- The Bloomberg Dollar Spot Index declined 0.6%.

- The euro rose 0.2% to $1.1127.

- The British pound gained 1% to $1.2464.

- The Japanese yen strengthened 0.2% to 107.6 per dollar.

Bonds

- The yield on 10-year Treasuries rose one basis point to 0.66%.

- Germany’s 10-year yield increased four basis points to -0.41%.

- Britain’s 10-year yield climbed five basis points to 0.23%.

Commodities

- West Texas Intermediate crude declined 1.4% to $35 a barrel.

- Gold strengthened 0.5% to $1,738.52 an ounce.

– Bloomberg