Buy Pound To Dollar Rate, Target 1.4585 Say MUFG

Mobility Data Indicates Strong UK Rebound BoE Rate Hike Speculation to Intensify Dollar to Remain on the Defensive

MUFG expects that the UK economic recovery will continue to gain traction with expectations of a Bank of England rate hike leading to higher yields which will boost the Pound.

With strong capital inflows and the dollar remaining under pressure, the bank recommends buying the Pound to Dollar (GBP/USD) exchange rate at 1.4175 with a target of 1.4585 and stop loss of 1.3950.

Mobility Data Indicates Very Strong UK Rebound

MUFG recognises the risk posed by coronavirus developments, but does not consider that the recovery is at risk.

“While there is a danger that the Delta variant delays the full reversal from lockdown, the high frequency data suggests a very strong rebound in economic activity is well underway anyway.”

Indeed, the bank is particularly optimistic on the UK mobility data, especially in a global context, which suggests that there will be a strong rebound in activity.

“The latest readings show the UK has now surpassed our EZ measure and the US. UK activity is likely surging more than assumed.”

MUFG expects that the April UK GDP data on Friday will reinforce the positive trend.

BoE Rate Hike Speculation to Intensify

The bank also notes more hawkish rhetoric from the Bank of England with a particular focus on the housing market.

Halifax reported that house prices increased 1.3% for May with a 9.5% annual increase from 8.2% previously which is likely to reinforce these concerns over housing inflation. These concerns are also likely to be lead to markets pricing in a UK rate hike.

MUFG notes; “The GBP OIS market is drifting higher but there is ample scope for greater tightening to be priced for 2022.”

The bank expects that higher yields will reinforce Sterling’s appeal in global currency markets.

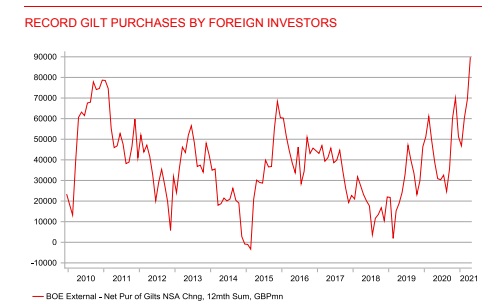

MUFG also notes that there have been strong capital flows into the UK. Foreign investor purchases of gilts totalled GBP 11.3bn for April, which on a 12mth rolling basis amounted to GBP 89.8bn – a record one-year total.

Above: UK gilt purchases chart

The bank expects that strong capital inflows will continue to provide net Pound Sterling support.

“GBP is already the 2nd best performing G10 currency this year but we see scope for that outperformance to continue over the coming months.”

US Dollar to Remain on the Defensive

The dollar secured some respite last week, but the recovery was halted by a weaker than expected employment report on Friday with the increase in non-farm payrolls held to 559,000.

MUFG expects that the US currency will remain vulnerable on yield grounds; “The continuation of loose Fed policy leaves the US dollar vulnerable to further weakness in the near-term.”

GBP/USD maintained a slightly weaker tone on Monday to trade just below 1.4150.