According to MUFG analysts, the US Dollar (USD) remains overvalued in global currency markets. Inflation differentials will widen the gap and weaken the currency further if the Fed keeps interest rates close to zero.

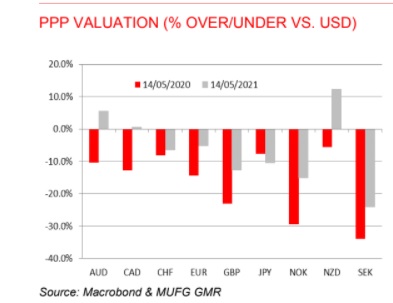

The Norwegian and Swedish currencies are still undervalued and best placed to gain, but the Australian and New Zealand currencies are now overvalued, limiting the scope for further gains.

“Overall, the results support our fundamental macro views that there is still scope for the NOK and SEK to strengthen further and for the USD to continue weakening while US yields remain at less attractive levels than pre-pandemic.”

Above: Global currencies valuation chart

Dollar Still Overvalued after a Dramatic Year of Global Currency Moves

MUFG notes that there have been very big shifts in exchange rates over the past 15 months and takes the opportunity to examine longer-term valuations.

“Our long-term Purchasing Power Parity valuation models reveal that there have been some dramatic shifts in G10 FX valuation over the past year.”

According to MUFG, the largest shifts have been seen in the Australian and New Zealand currencies. The bank’s model suggests that the Australian dollar is now overvalued by around 6% after being undervalued by 11% last year while the New Zealand dollar is now 12% overvalued compared with under-valuation of 11% last year.

The Canadian dollar is now close to fair value after strong gains.

The Japanese yen is now seen as undervalued by 10%, little changed from the previous year, with the Swiss franc 7% undervalued.

MUFG considers that the Norwegian krone is undervalued by around 15% and Swedish krona 24% respectively despite a strong recovery .

Inflation trends will be important and higher US inflation would further erode the dollar’s estimate of fair value.

Goldman Sachs notes; “If, for example, US inflation runs 1% above Euro area inflation for five years, models would say that EUR/USD “fair value” should rise by 5%.”

Goldman adds that currencies can defy longer-term pressures, but this is dependent on a response by the central bank to raise interest rates and boost real yields.

In this context, the dollar will be vulnerable to further net losses if the Fed fails to respond.

The MUFG model shows that the Euro is undervalued by around 13% and the Pound Sterling 5% below the estimate of fair value. This suggests that the downside should be limited for the Euro to Dollar (EUR/USD) exchange rates and Pound to Dollar (GBP/USD) exchange rate.