Bitcoin Crash Opens Door To A Tax Loophole For Investors

Bitcoin, ethereum, dogecoin and other cryptocurrencies have seen prices plunge in recent weeks. These investors can leverage those losses in a way that a typical stock or mutual fund investor can’t. That’s because the so-called wash sale rules don’t apply to crypto, according to financial advisors. But there are important caveats.

Crypto investors may be shellshocked by a recent plunge in prices. But that sell-off has a silver lining: It opens the door to a money saving tax strategy.

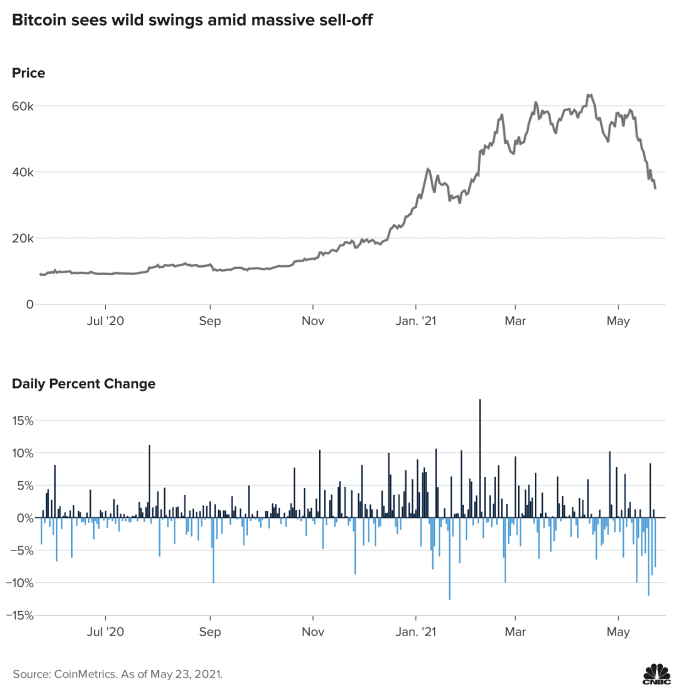

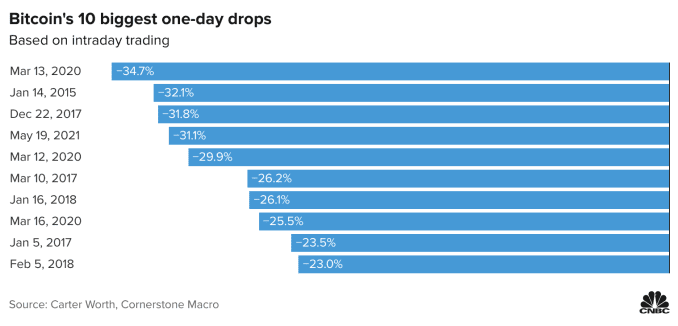

Popular cryptocurrencies like bitcoin and ethereum shed more than half their value in volatile trading over the past month or so.

A bitcoin investor who bought at the mid-April peak (around $65,000) and sold low on Wednesday (near $30,000) would have lost 54%, for example.

But crypto losses are treated differently than those of stocks and mutual funds. That’s because so-called wash sale rules don’t apply, according to financial advisors.

This offers two benefits to crypto investors: They can sell crypto for a loss, and then use that loss to reduce or eliminate capital gains tax on winning investments. Then, they can quickly buy back the crypto they sold so as not to miss out on a subsequent rebound in price.

The first benefit (called “tax-loss harvesting”) is allowed for stocks and other securities. However, the second benefit isn’t — stock investors aren’t allowed to buy the same or similar security within 30 days before or 30 days after a sale without triggering penalties.

“This is a loophole, so to speak,” Ivory Johnson, a certified financial planner and founder of Delancey Wealth Management in Washington, said of crypto relative to tax rules. “It’s heads I win, tails you lose.”

Crypto tax benefit

The so-called loophole exists due to the fact that regulators don’t consider cryptocurrencies to be “securities.” Instead, the IRS taxes them as property, Johnson said.

The tax treatment could make a big difference for an asset as volatile as cryptocurrency has been in recent weeks, according to financial advisors.

Let’s take the example of a bitcoin investor who bought high and sold low, incurring a $35,000 loss. This year, the same person also sells stocks and mutual funds for a $35,000 gain. The bitcoin loss would erase taxes on the capital gains.

Further, this same investor could have quickly re-bought bitcoin near its $30,000 low and participated in any run-up. Its price jumped more than 10% on Monday. Some bitcoin bulls expect the asset to reach $100,000 by year-end.

By comparison, a stock investor would miss out on 30 days of potential gains after a sale due to the wash sale rules.

“It lets you completely manipulate [crypto] on the downside and use it to create a tax [benefit],” said Leon LaBrecque, a CFP and accountant at Sequoia Financial Group in Troy, Michigan.

Importantly, while this tax benefit applies to cryptocurrencies like bitcoin, ethereum and dogecoin, it wouldn’t for investors in crypto-related securities.

“You couldn’t dodge the wash with [crypto platform] Coinbase,” LaBrecque said. “But you clearly could dodge the wash with crypto.”

Caveats

However, there are important caveats.

Regulators may crack down on these rules in the future, according to financial advisors. However, it’s unlikely that transactions occurring before any clampdown would be overturned, they said.

The IRS declined comment for this story. The Securities and Exchange Commission didn’t respond to a request for comment.

Investors may also inadvertently run afoul of other existing rules if they’re not careful.

Crypto sales must still have “economic substance” or investors risk the IRS labeling them “sham” transactions, according to Jeffrey Levine, a CFP, accountant and chief planning officer at Buckingham Wealth Partners on Long Island, New York.

SIGN UP FOR OUR NEWSLETTERYOUR WEALTH

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

The IRS essentially wants an investor to bear some economic risk for the sale — meaning some risk of loss, Levine said.

Investors who hit the bitcoin sell button and buy it back a second later risk the IRS negating the tax benefit. But the timing isn’t black and white.

“Time is always your best argument,” Levine said. “But given the volatility, and the fact it’s constantly trading, I think you have much more flexibility with crypto than you do with anything else.

“A day is more than sufficient,” he added. “I’d feel comfortable defending that to the IRS.”

– CNBC