Nigerian E-Naira Currency Could Be A ‘Game Changer’ But Banks Will Have To Adapt

Nigeria is set to test a central bank digital currency from October, a move that could reshape the country’s financial landscape and push legacy banks to adapt the services they offer.

A central bank digital currency, or CBDC, could help the regulator limit black market trading in the naira, bolster in-bound remittances and reduce so-called leakages from state-funded social programs, according to industry observers.

A 2020 survey showed 86% of 60 polled central banks are exploring the possibility of launching their own digital currencies, and Nigeria is one of several African countries assessing a government-backed digital currency. CBDCs, such as Nigeria’s e-naira, will be centralized digital representations of a country’s currency, whereas cryptocurrencies are decentralized digital tokens.

In Nigeria, Africa’s largest economy and most populous country, banks are not permitted to hold, trade or transact in cryptocurrencies. But the launch of the e-naira is likely to have a big impact on the financial sector.

“It could be a game changer,” said Iyinoluwa Aboyeji, ex-CEO of Flutterwave, a Nigeria-based, pan-African payments provider. “The challenges in the financial system are the sort of challenges that a well-designed and implemented digital currency could solve.”

Black market currency exchange is rife on the streets of Lagos, Nigeria’s largest city. Source: Getty |

“The banks that develop the capability to hold the digital currency and distribute it, they will likely become much bigger banks than those who lack that capacity,” Aboyeji said. “The banks that aren’t technologically inclined or ready for this digital currency change will likely fall very far behind. People will just decide not to do much banking with them.”

A digital currency would also boost the effectiveness of state-funded social programs. These typically suffer considerable “leakage,” but a blockchain-based currency’s in-built traceability could prevent this, said Aboyeji.

Growing popularity of crypto

The naira’s prolonged slump has spurred growing numbers of Nigerians to buy cryptocurrencies as a hedge against the declining value of their savings. Following the central bank’s ban on using local bank accounts to buy cryptocurrencies, Nigerians switched to peer-to-peer platforms that circumvent these rules.

“People are increasingly using bitcoin, but whether it will become a currency in Nigeria [it] is too early to say,” said Olumide Adesina, a Lagos-based independent financial market analyst. “Crypto use is increasing day by day.”

Nigerian bitcoin trading app KoinWa began as an exchange but was redesigned as an escrow-based peer-to-peer platform following the regulator’s prohibition on banks being involved in cryptocurrencies. That change has accelerated the platform’s growth, according to KoinWa CEO Hakeem Dosu. He said trading volumes are growing fivefold per month but declined to provide further details.

In May, Nigeria received $2.4 billion worth of cryptocurrency compared with $684 million in December 2020, according to blockchain research firm Chainalysis.

Solving problems

An e-naira could help to address several problems in Nigeria, including financial inclusion. Since the start of the pandemic, banks have shut scores of branches, reopening only those in major urban areas, in what may amount to permanent closures while also failing to develop an agent network as a replacement, said ex-Flutterwave CEO Aboyeji.

|

“The central bank wants to be able to more directly issue currency against the dollar, and it wants to be able to track and trace where dollars are coming from and where naira is being exchanged for dollar. A digital currency could help them do that.”

The central bank has long sought to prevent so-called round-tripping, where banks sell hard currency bought from the regulator on the black market for an easy profit, and an e-naira could make such activities impossible, according to analysts. In a February 2021 report, the IMF said Nigeria’s government rejected the organization’s estimate that the country’s currency was overvalued by about 18.5%.

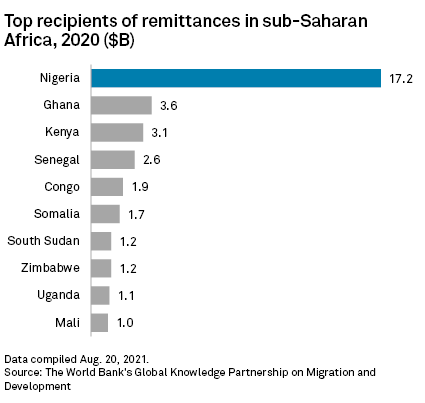

Remittances to Nigeria were $17.2 billion in 2020, down 27.7% year on year, according to the World Bank, which attributed the decline to a 27% premium on the naira-dollar black market exchange rate and the central bank’s directive that local exchange houses pay out remittances in hard currency. Total remittances also declined 2.1% in 2019 versus 2018.

Challenges ahead

Tests by South Africa’s central bank found that decentralized platforms could process only 20 transactions per second versus 65,000 on Visa’s network, the IMF said in a report.

Nearly four-fifths of the world’s central banks are either not permitted to issue a digital currency or their legal framework is uncertain, according to a separate IMF review of 174 central banks.

However, the popularity of bitcoin has made a significant minority of Nigerians comfortable with cryptocurrencies, according to Aboyeji.

|

“I see bitcoin losing a lot of market share,” Aboyeji said. “The average bitcoin consumer is someone who cannot access foreign exchange through traditional channels, but with this digital currency, if it’s well implemented, the central bank has an opportunity to serve these people directly.”

– S&P Global