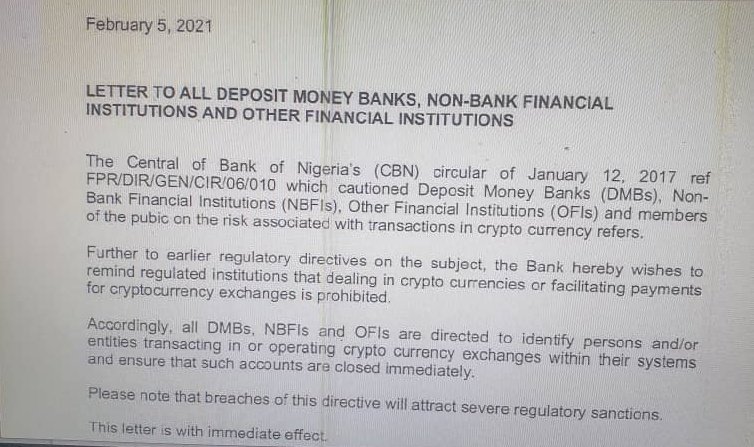

The Central Bank of Nigeria (CBN) has reportedly issued circular directing financial institutions against dealing with cryptocurrencies or providing services to cryptocurrency exchanges.

The circular allegedly dated February 5 2021, clearly states that all deposit money banks (DMBs), Non-Financial Institutions (NBFIs), and Other Financial Institutions (OFI) must identify their customers who deal with cryptocurrency and close their accounts immediately.

Banks that fail to comply with the directive will “attract severe regulatory sanctions,” the circular warns.

Source: (@Asemota)

The latest directive represents a tougher stance on cryptocurrencies than an earlier 2017 circular from CBN, where it warned financial institutions that chose to serve crypto clients that they did so at their own risk.

It also comes as a surprise given the Nigerian Securities and Exchange Commission (SEC) had promised to publish further guidance on how the country will regulate cryptocurrency.

Is the CBN Ban on Crypto Already in Effect?

With the apex bank circular dated with immediate effect, Nigerian cryptocurrency holders already report issues withdrawing funds from exchanges, with the said banks declining to process the transactions. Some banks are also reportedly threatening to ‘flag’ or close customer bank accounts if they do not stop using it to move funds to and from crypto exchanges.

Nigeria is unarguably Africa’s largest bitcoin market, according to several metrics. On Binance alone, the BTC/NGN pair recorded an 11 billion naira ($28.8 million) volume in the last 24 hours, with the peer-to-peer platform, Paxful recording an average $2.8 million daily volume.

The Nigerian crypto market’s rapid growth has largely been buoyed by the nation’s restrictive financial system and inflationary currency that has dipped by over 30% against the dollar amid the coronavirus pandemic.

Until now, users can easily buy cryptocurrency via debit cards or bank transfer on cryptocurrency exchanges and also convert crypto to Naira seamlessly. However, the rumored ban will introduce new restrictions that the burgeoning market will take a while to get to grip with.

Worth noting is that Nigeria’s central bank is now walking the same path as the Reserve Bank of India (RBI) which issued a similar circular to local banks in 2017. Last year, the prohibition was ruled as unjust by the Indian supreme court, paving the way from cryptocurrency businesses to start flourishing.